Our Industry Teaches “Comp is Comp is Comp and there’s nothing you can do about it”

Workers’ Comp is the way employers finance employee injuries. For every dollar the insurance company spends, they are likely to pay back $2.00 to $3.00. It’s our job to give you the tools to keep your clients from borrowing at such high-interest rates.

Because Workers’ Comp is so complicated and confusing, employers are left to assume that their premium audit reports are accurate and their Experience Modification Factors are correct. However, because of mistakes rampant in the Workers’ Compensation system, at least 50% of businesses are overcharged for their Workers’ Comp insurance.

That’s just the beginning. CWCA’s commitment to on-going workers’ compensation education means that they know the practical, proven processes that reduce Workers’ Comp expenses over the long-term, making employers more competitive. Since 2001, CWCAs have saved businesses millions of dollars in unnecessary Workers’ Compensation expenses, including one Advisor who has reduced his clients costs by $50,000,000 dollars in the 16 years since he joined the Institute.

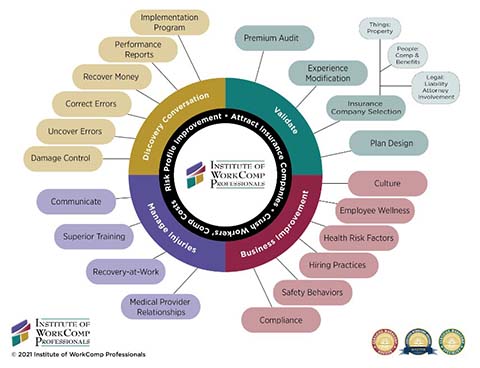

It’s the Institute’s Process that delivers measurable, long-lasting, cost-saving results for employers.

Stop thinking of Workers’ Comp as insurance to really understand it.

Workers’ Comp is the only insurance over which you and your clients have complete cost control. CWCA’s have the definitive process to recover the money you’ve already paid for your Workers’ Comp insurance, and then create an overcharge-free program.

Once you understand why errors occur, you can see how easily your clients leave money on the table.

Causes of errors

- Not knowing your minimum Experience Modification Factor.

- Not having a process to help a client reach their minimum Experience Mod to unlock the capital locked up in their mod

- Misclassifying employees.

- Injured employees off the job too long receiving insurance company money.

- Lower productivity and mistakes when injured employee is off, and others, less experienced, fill in.

- Workflow disruptions when an employee is injured.Poor hiring practices put “injury prone” persons on the payroll.

- Inadequately trained supervisors.

- Delays in reporting employee injuries.

- Management and employees not understanding how Workers’ Comp works, such as how long an injured employee must wait before receiving their the first lost wage check.

- The cost of slow response by medical providers, claims adjusters and/or employers when an injury occurs.

Look how many people are involved in the WC system, errors are bound to happen:.

- Underwriters, who determines classifications and pricing.

- Claims adjuster when an employee suffers an injury.

- Medical providers who may not be familiar with Workers’ Comp system.

- Premium auditors.

- Insurance agent and staff.

- State rating bureaus.

- State regulatory bureaus.

- The Employers Workers’ Comp team.

Conclusion: Workers’ Comp doesn’t pay for employee injuries. Employers do!

Employers pay for their employee’s injuries. That’s why it’s so critical to have a proven process in place any time an injury occurs.

The Workers’ Comp policy levels out the peaks and valleys of injury costs by financing them over a three- to four-year period.

With insurance company claims adjusters buried under heavy caseloads, agencies and employers must have a process in place to minimize the cost of an injury and expedite an injured employee’s return to work.

To hand the responsibility for managing Workers’ Comp claims to the insurance company leaves employers exposed to higher than necessary costs.

Having a process to manage an employer’s workers’ compensation program from quoting through the audit is the key to being sure that the check they write is right! This is where the Institute comes in.

Results tell the story

The success stories tell how CWCAs have helped employers from those with a small workforce to those with thousands of employees.

For example, with OSHA on the prowl, you want to know what to do when they knock. In the same way, a CWCA would provide you information on PEOs if you were exploring the possibility of entering employee leasing.

The results tell the story

The success stories tell how CWCAs have helped employers from those with a small workforce to those with thousands of employees. Click here.

Employers make more money by working with Certified WorkComp Advisors

The Institute trains insurance agency personnel to become Certified WorkComp Advisors who understand the entire Workers’ Comp system. Today, there are more than 1000 certified members of the community across the country.

The Institute sponsors a variety of Workers’ Comp educational opportunities for Advisors, as well as Certified WorkComp Specialists who support Advisors in more than 200 insurance agencies.

The depth of the Institute’s knowledge, tools, and support network make it the leader in training insurance agents as experts in Workers’ Comp and Injury Management solutions.

Certified WorkComp Advisors provide significant employer benefits

- Locate mistakes in Experience Modification Factors and follow through to make sure they are corrected.

- Verify audit to identify and correct mistakes and errors in preparation for the insurance company auditor.

- Obtain refunds for “money left on the table.”

- Demonstrate to employers how they and not the Insurance Company ultimately pay for injury costs.

- Demonstrate to employers how “Bidding and Quoting” their Workers’ Compensation Program is their least effective strategy to drive down their costs.

- Help employers establish a process for reducing costs and eliminating future errors.

- Help employers with their hiring process, where Workers’ Compensation problems start.

- Focus on obtaining the right treatment, from the right doctor at the right time to provide the most effective care to injured employees.

- Train supervisors on the importance of and how to manage their employees when they are injured on the job.

- Help employers minimize the risk of losing a valued employee when they are injured and enter the Work Comp System.

- Create a process to get injured workers back on the job quickly and fairly.

- Assist in implementing processes that reduce lost workdays due to injury by 60% to 80%.

- Assist employers in reducing litigation arising from injured employees.

- Serve as a continuing advisor to employers.

The Institute also keeps Advisors up-to-date on rule changes and new tools for enhancing the results they achieve for employers.

The Institute’s Process as practiced by Certified WorkComp Advisors makes a significant difference for employers.

Here’s what a few have to say.